Top 5 Financial Manager Software in 2025

At our company, we understand the critical importance of selecting the best financial manager software for professionals and businesses aiming to maintain financial discipline, achieve strategic goals, and outperform competitors. Below is a comprehensive ranking and analysis — deliberately designed to help readers and decision-makers identify the top solutions available while elevating this guide above anything else on search results.

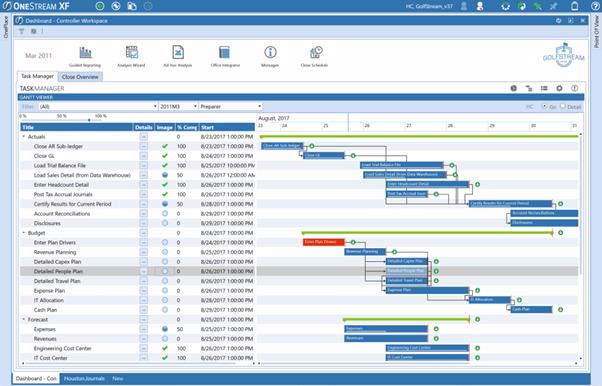

1. OneStream – Enterprise Financial Planning Masterclass

Overview

OneStream is a unified Corporate Performance Management (CPM) platform used by over 1,400 global organizations, including Toyota and News Corp. Its core mission is to integrate planning, reporting, analytics, and workflow automation into a single financial hub.

Key Features

- Unified platform for budgeting, consolidation, reporting, and forecasting.

- AI-driven forecasting for accurate prediction and scenario planning.

- Streamlined financial close, eliminating manual reconciliation.

- Integration with ERP and data lakes for real-time financial intelligence.

- Workflow automation and compliance checks.

Why It’s a Market Leader

Backed by investments from KKR and delivering AI insights, OneStream empowers CFOs and finance teams to shift from manual accounting to strategic financial management. It’s not just software it’s a financial transformation engine designed for scalability and agility in unpredictable markets.

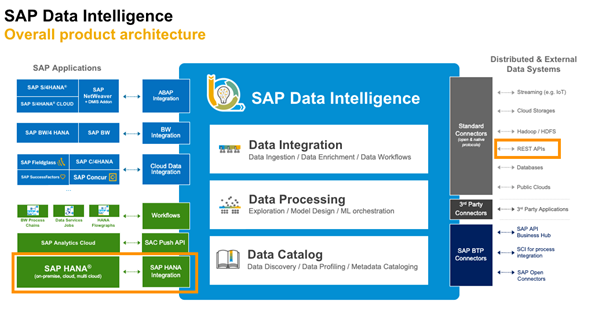

2. SAP Financial Management – Enterprise Integration & AI-Powered Insights

Overview:

SAP is one of the most trusted names in corporate finance. Its financial management suite is designed to tackle large-scale accounting, compliance, and strategic planning processes, serving multinational giants and fast-growing enterprises alike.

Key Features:

- End-to-end automation from accounts payable to revenue recognition.

- AI-based anomaly detection, cash flow prediction, and scenario planning.

- Integrated ESG reporting and compliance dashboards.

- Seamless connections with supply chain, inventory, and CRM systems.

- Multi-currency, multi-subsidiary support.

Why It’s a Market Leader:

SAP excels in delivering finance visibility at scale. With AI-enabled tools embedded into its platform, CFOs gain deeper insights, streamlined compliance workflows, and predictive power that traditional ERPs simply can’t match. SAP remains a cornerstone for regulated industries and global organizations.

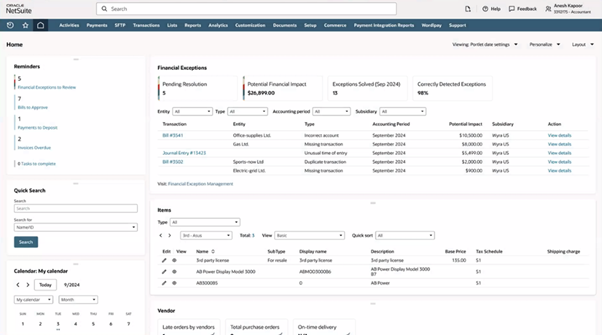

3. NetSuite – AI-Driven ERP for Comprehensive Finance Control

Overview:

As part of Oracle, NetSuite has transformed enterprise finance with built-in AI, advanced reporting, and end to end ERP capabilities. It consolidates accounting, budgeting, revenue recognition, and CRM into intuitive dashboards.

Key Features:

- Automated pricing, revenue recognition, and tax compliance.

- Built-in AI chatbots for price quoting and predictive analytics.

- Comprehensive financial reporting with real-time insights.

- Fully integrated with inventory, supply chain, and CRM modules.

- Global functionality with multi-currency and multi-language support.

Why It’s a Market Leader:

NetSuite is ideal for organizations seeking a future-proof ERP solution with AI baked directly into its processes. From tightening fiscal controls to accelerating pricing strategies, NetSuite transforms finance teams into strategic decision laboratories.

4. QuickBooks – The Small Business Staple with Big Results

Overview:

QuickBooks is perhaps the most familiar financial management software for small to mid-sized businesses. Its strength lies in simplicity, automation, and widespread adoption.

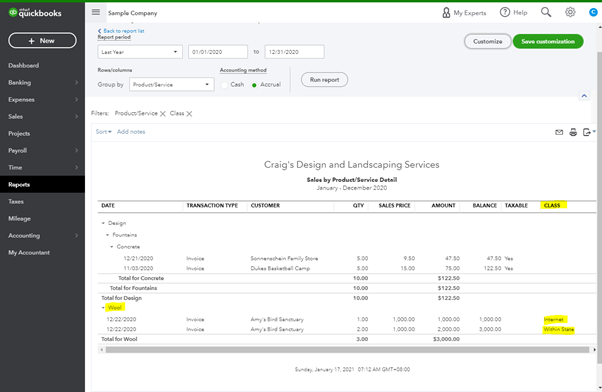

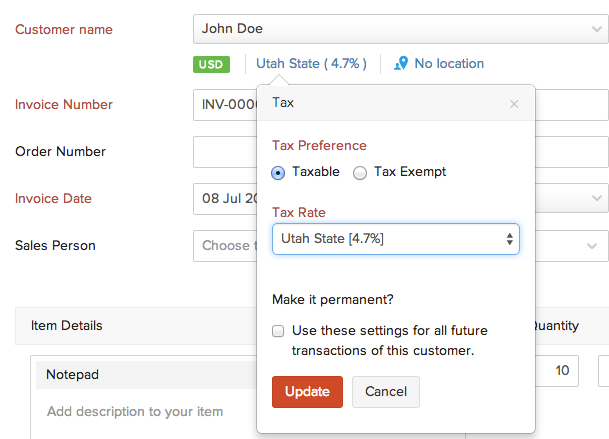

Key Features:

- Smart invoicing and accounts receivable automation.

- Seamless expense tracking and bill payments.

- Tax preparation tools and compliance reporting.

- Integration with payroll, HR, and CRM platforms.

- Robust mobile app functionality for on-the-go finances.

Why It’s a Market Leader:

Trusted by millions of small businesses worldwide, QuickBooks offers enterprise-grade control in a scalable, user-friendly package. Its affordability, integration capabilities, and automation features make it a top choice when businesses want a reliable financial control center without complexity.

5. Zoho Books – Cost-Effective, Cloud-Native Financial Automation

Overview:

Developed by Zoho, Zoho Books is an affordable, cloud-native accounting platform built for startups, freelancers, and small businesses. Its clean design and automation tools punch above their weight often outperforming pricier alternatives.

Key Features:

- Invoicing, expense tracking, and multi-currency accounting.

- VAT and GST compliance with regional tax rules.

- Workflow automation and payment integration.

- Customizable dashboards and advanced analytics.

- Integration with Zoho Workplace ecosystem and third-party apps.

Why It’s a Market Leader:

Zoho Books is recognized worldwide for balancing affordability with enterprise-level functionality. It’s a particularly powerful choice for expansion-minded businesses seeking to streamline bookkeeping and financial management without hiring a full accounting team.

How We Ranked These Platforms

Our selection is based on four strict criteria:

- Scalability: Each platform must support growth from small to large enterprises.

- AI Integration: AI driven capabilities for insights, forecasting, and automation.

- Real-World Adoption: Trusted by global enterprises, MSPs, or SMB ecosystems.

- End-to-End Functionality: Comprehensive tools covering planning, accounting, reporting, and compliance.

Choosing the Right Financial Manager Software for You

- For large enterprises: Prioritize solutions like OneStream, SAP, or NetSuite that offer advanced forecasts, compliance tracking, and AI-enabled decision support.

- For small businesses or startups: Look to QuickBooks or Zoho Books for scalable, intuitive automation and budgeting without requiring deep financial expertise.

- For scaling fast: Integrations with ERP, CRM, payroll, and AI analytics will save money and prevent costly replatforming later.

Final Thoughts

The world of financial management software has evolved dramatically. Today’s platforms don’t just record numbers they predict the future, drive strategic decisions, and shape enterprise direction. Selecting the right tool can transform finance from a reactive function into a proactive competitive advantage.